Bitcoin & Crypto Markets Are Changing

Bitcoin displayed a strong performance in January, rising by 9% and closing the month above $100,000. Over the past several weeks, it has been fluctuating within a range of $92,000 and $107,000. This sideways movement is perceived as reaccumulation, supported by on-chain metrics indicating that holders possessing more than a thousand Bitcoin are once again accumulating. The duration of this consolidation phase is uncertain, but the overall sentiment is optimistic for a robust February. Conversely, altcoins have continued to lose value against Bitcoin, with the highly anticipated altcoin season yet to materialize. In this article, we will delve into the potential developments that February could bring for Bitcoin and the altcoins market.

When Will Bitcoin Reach its Peak: Understanding Key Signals

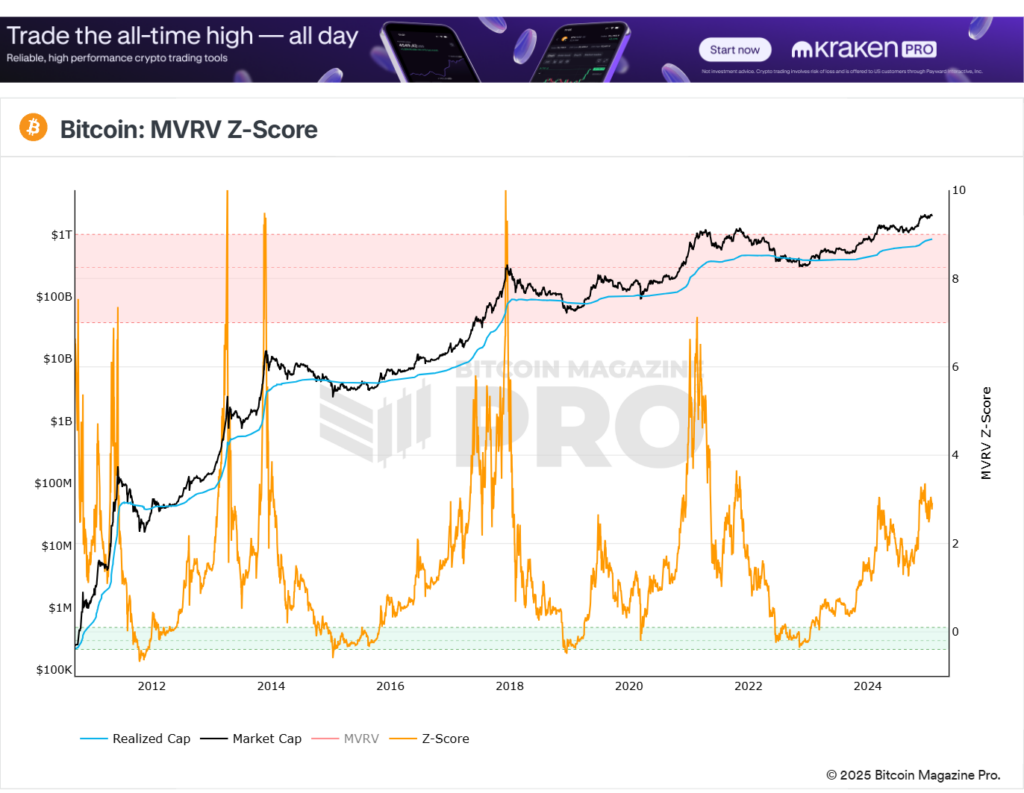

While acknowledging that no indicator is infallible, there are several indicators that have shown reliability in predicting the peak of the Bitcoin cycle. In future discussions, I will delve into some of these indicators and outline what signals to observe for recognizing the cycle’s apex. In this segment, the focus is on the MVRV z-score. This particular indicator has demonstrated its effectiveness in guiding when to enter or exit Bitcoin positions on a broader scale. Although I do not recommend selling Bitcoin for long-term investors, this indicator can serve as a valuable tool in your trading strategy. As illustrated in the chart below, the strategy of buying when the indicator enters the green zone and selling when it enters the red zone has historically proven to be very profitable. Notably, the previous cycle only marginally touched the red zone, showing that the last cycle was not as strong as previous cycles. It is essential to exercise caution, as all indicators are not foolproof, and having an exit plan when Bitcoin surpasses level six would be prudent for those considering selling their holdings. Currently the MVRV Z-Score is a little above 3 and nowhere near the 7.5 level indicating we are still far from reaching the peak in this current cycle. I will be closely monitoring this indicator for any indications of an approaching market top in the upcoming months.

Click Here To View The Live Chart

Bitcoin Strategic Reserves

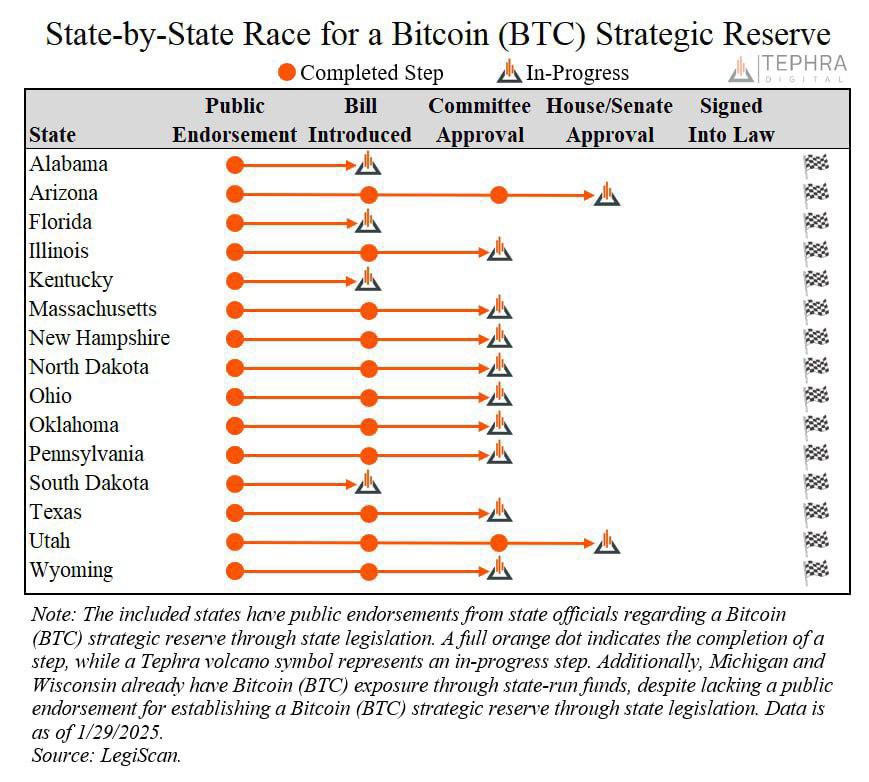

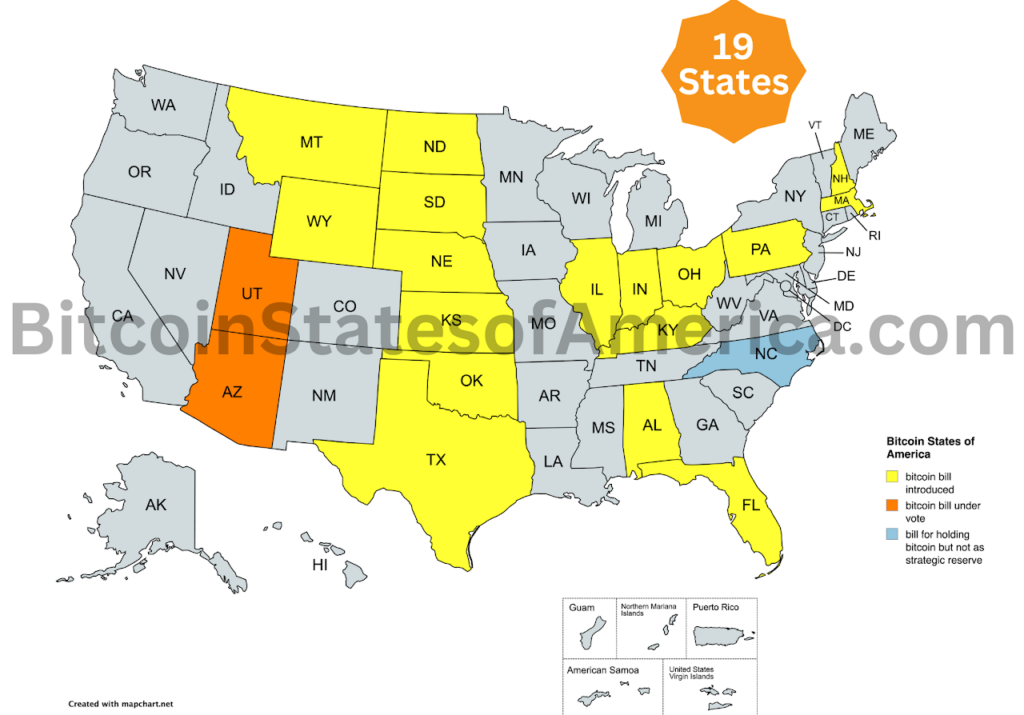

Eighteen states have submitted bills to create a Bitcoin and/or digital asset strategic reserve. Utah and Arizona have already passed their bills through committee, with the next step being a debate and vote on the state congressional floor. It is evident that state politicians recognize the political value in supporting Bitcoin, and some are beginning to acknowledge the risks posed by U.S. dollar debasement to their state’s financial stability. Unlike the federal government, states can adopt legislation much more quickly, making it increasingly likely that the question is no longer “if” but “when” a state will officially establish a Bitcoin reserve.

On the national front, Senator Cynthia Lummis of Wyoming is advancing a U.S. Bitcoin strategic reserve bill, which may be fast-tracked to the congressional floor by June. Insert link to bill here. Her efforts have gained momentum following news that the Czech Republic’s central bank is studying the benefits of allocating 5% of its reserves to Bitcoin. Such a move would represent an over $8 billion investment, making it the first central bank to officially place digital gold on its balance sheet.

Corporate Adoption: The Growing Demand for Bitcoin Reserves

Corporate adoption remains the most robust sector for Bitcoin reserves. MicroStrategy continues to purchase Bitcoin aggressively on a weekly basis. Other companies, including Metaplanet, Semler Scientific, and Marathon Digital, have adopted similar strategies—issuing debt to accumulate Bitcoin. With over 70 publicly traded companies now holding Bitcoin on their balance sheets, the corporate race to acquire Bitcoin is accelerating rapidly.

In January, the SEC repealed and withdrew SAB-121, which previously restricted banks and financial institutions from providing Bitcoin and digital asset custody services. With this reversal, banks are now permitted to custody crypto, marking a game-changing moment for Bitcoin adoption. This shift will lead to a surge in lending products that use Bitcoin as collateral. As competition among banks intensifies, interest rates for borrowing against Bitcoin will become increasingly competitive. For Bitcoin holders, this presents a new financial paradigm—eliminating the need to sell Bitcoin to cover expenses. Instead, through interest-only loans, they can leverage their Bitcoin holdings while maintaining ownership and benefiting from Bitcoin’s long-term price appreciation. This dynamic is expected to reduce the available Bitcoin supply and drive its value to new heights.

The Financial Revolution: Bitcoin as the Ultimate Collateral

Game theory is unfolding in real time. Corporations, states, banks, and even nation-states are moving to acquire Bitcoin, signaling a transformative shift in the financial sector. Over time, this movement will disrupt the current financial system. Bitcoin’s finite supply and 24/7 market liquidity make it an ideal form of collateral. Those who hold Bitcoin will gain access to financial tools that allow them to leverage their holdings for further asset accumulation—gradually reducing their reliance on the U.S. dollar. The future of finance is being rewritten, and Bitcoin is at the center of this revolution.

Altcoins Continue to Drop in Bitcoin Valuation

January saw several altcoins make gains, with XRP and Solana briefly reaching new highs. However, both remain significantly down when measured against Bitcoin. At the time of writing, XRP is down 86% versus Bitcoin since 2017, while Solana remains 50% below its all-time high in Bitcoin valuation. Meanwhile, Bitcoin dominance has surged, remaining consistently above 58% and even touching 60% during the month.

With most Bitcoin purchases now coming from institutions and ETF buyers, there is a strong case that an altcoin season similar to previous cycles may not materialize. Historically, retail investors drove altcoin seasons by reinvesting Bitcoin profits into altcoins in search of even higher returns. However, institutions, pension funds, nation-states, and banks are unlikely to sell Bitcoin to chase speculative altcoins.

The Shifting Landscape of Altcoin Investing

In both 2017 and 2021, capital rotated from Bitcoin into altcoins, allowing savvy investors to accumulate Bitcoin through altcoin trading. However, retail investors have played a significantly smaller role in this cycle, and with over 36 million tokens in circulation, finding altcoins that outperform Bitcoin has become increasingly difficult. While some altcoins will experience short-term rallies, few will sustain long-term gains in Bitcoin valuation.

As a result, I have reevaluated my portfolio strategy. The opportunity to 5x or 10x my Bitcoin holdings through altcoins appears significantly diminished. Because of this, I have begun selling underperforming assets, reallocating funds into stablecoins and interest-bearing assets such as JLP. At current levels, Bitcoin presents limited short-term upside, leading me to take a more cautious approach.

A New Portfolio Strategy

Despite maintaining a significant altcoin position, I have concentrated my holdings in the strongest projects while increasing my cash and cash-equivalent reserves. My new strategy is to exit any altcoin that experiences a significant run against Bitcoin and convert gains into Bitcoin.

My thesis is that Bitcoin dominance will remain above 50% for this entire cycle. The bulk of new capital entering the market is coming from institutional players who are not interested in chasing the next meme coin or speculative layer-one blockchain. While some altcoins may achieve 20x, 50x, or even 100x returns, the difficulty in identifying them has increased, making the search too time-consuming and risky to justify.

Instead of gambling on altcoins, I have embraced a lower-risk, lower-reward approach with less emphasis on accumulating more Bitcoin through altcoin trading. With Bitcoin-backed lending now gaining traction, I intend to leverage my Bitcoin holdings to acquire more Bitcoin in the future, rather than risk capital in a declining altcoin market.

The market is evolving, and my investment strategy must evolve with it. By maintaining a strong cash position, I retain the flexibility to pivot back into altcoins should my thesis be incorrect and Bitcoin dominance experiences a significant decline.

Ethereum Could Trigger Alt-Season

Ethereum has been in a three-year downtrend against Bitcoin, currently down 66%. While Ethereum has experienced similar downturns in past cycles, it has historically rebounded with sustained rallies. In previous bull markets, Ethereum has surged for six-month periods, dramatically increasing its Bitcoin valuation. However, this cycle appears different.

Competitors like Solana and SUI are eating into Ethereum’s market share, while Ethereum’s own Layer 2 solutions—originally designed to enhance Ethereum’s usability—have fragmented liquidity and complicated the user experience. In January, Ethereum initially appeared to form a bottom against Bitcoin, but the trend has since reversed, with Ethereum losing another 7% in Bitcoin valuation for the month.

For a true altcoin season to emerge, Ethereum must establish a prolonged uptrend against Bitcoin. If this occurs, capital may begin rotating into mid-cap and smaller-cap altcoins, ultimately leading to a breakdown in Bitcoin dominance. Until a definitive trend shift occurs, I remain committed to the view that Bitcoin will remain the dominant cryptocurrency throughout this cycle.

Closing Thoughts

As we move deeper into 2024, Bitcoin continues to assert its dominance in the crypto market. The institutional adoption of Bitcoin is accelerating, and its use as collateral in financial markets is increasing. Meanwhile, altcoins struggle to gain ground against Bitcoin, and Ethereum has yet to show the kind of sustained uptrend that could trigger a broader altcoin season.

The broader crypto market is evolving. Institutions, banks, and even governments are beginning to recognize Bitcoin’s value as a strategic asset. The days of retail-driven altcoin cycles may be behind us, replaced by a new era of institutional accumulation. With Bitcoin-backed lending and corporate treasuries continuing to expand, we may see Bitcoin’s dominance persist for the foreseeable future.

For now, my focus remains on Bitcoin accumulation, maintaining flexibility, and leveraging my holdings responsibly. The opportunity to speculate on altcoins still exists, but it is no longer the core strategy in a market increasingly shaped by large-scale financial players.

February holds the potential for more volatility and continued institutional buying. Keeping a close watch on Bitcoin’s price action and on-chain metrics will be key to navigating the months ahead. Stay patient, stay informed, and keep stacking Sats.

All information provided is for educational purposes only. It is essential to conduct your own research before making any financial decisions. This is not intended as financial advice.

Links & Tutorials

Bitcoin Education Resources

Hope.com – Learn more about Bitcoin and how to use BTC to protect your wealth.

The Bitcoin Standard – Book by Saifedean Ammous – a must-read!

The Bitcoin Way – Go bankless! Bitcoin education and services to help you custody your Bitcoin safely and securely.

Swan Bitcoin – Bitcoin exchange, IRAs and institutional-grade custody solutions

River Financial – Bitcoin exchange and institutional-grade custody solutions

God Bless Bitcoin – Full Length Documentary

Freedom People Resources

People Pay – Accept Bitcoin payments for your business

Chainrecorder – Prove ownership immutably by recording your documents on the Bitcoin blockchain

U.S. Regulated Exchanges (Fiat Onramps)

Coinbase – Using Coinbase Advance Video

Kraken – Using Kraken Pro Video

KYC Credentials Outside the U.S.

Palau ID – Foreign residence to pass KYC on foreign exchanges.

KYC Exchanges that Accept Palau ID (Must Use VPN – Costa Rica, Columbia, Mexico, Panama)

No KYC Exchanges (Must Use VPN – Costa Rica, Columbia, Mexico, Panama)

Levex –

DEXs (Decentralized Exchanges) – Best Wallet To Use

Jupiter – Video Solana Ecosystem – Phantom Wallet

Whales Market – Solana OTC Trade Desk – Phantom Wallet

Thorswap – Swap native assets cross-chain (BTC for ETH etc..) and a very unique decentralized Bitcoin lending platform. Works best with the XDefi Browser Wallet.

Uniswap – Ethereum Ecosystem, EVM Compatible Chains, Rabby, Metamask and Phantom

Osmosis – Cosmos Ecosystem – Rabby, Metamask

Spooky Swap -Fantom – Rabby, Metamask

Trader Joe – Avalanche Ecosystem – Rabby, Metamask

Crypto Market and Portfolio Tracking

CoinGecko for portfolio tracking and up-to-date prices

CoinMarketCap – Crypto Prices

Banter Bubbles – Crypto Prices – Social Sentiment

Trading View – Chart all Markets and trading pairs Tradingview Tutorial Video

Storage – Not your keys, Not your crypto!

Cold Storage Wallets (Secure Long-Term Storage of Your Crypto)

Casa Custody Solutions – Multi Sig Storage and Inheritance

Cold Card (Bitcoin Only) – Video

Hot Wallets (Lower Security – interact with DAPPS and Smart Contracts)

XDefi Browser Wallet – Video1 Video 2

Warning-If you have a wallet and an NFT has been sent to your wallet that you did not mint or purchase.. NEVER click on it. Many have malicious code that can drain your wallet! – BE CAREFUL

Stay Free!

Kury

Responses